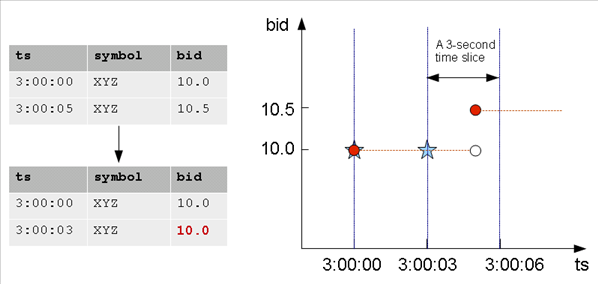

Constant interpolation

Given known input timestamps at 03:00:00 and 03:00:05 in the sample TickStore schema, how might you determine the bid price at 03:00:03?

A common interpolation scheme used on financial data is to set the bid price to the last seen value so far. This scheme is referred to as constant interpolation, in which Vertica computes a new value based on the previous input records.

Note

Constant is Vertica's default interpolation scheme. Another interpolation scheme, linear, is discussed in an upcoming topic.Returning to the problem query, here is the table output, which shows a 5-second lag between bids at 03:00:00 and 03:00:05:

=> SELECT * FROM TickStore;

ts | symbol | bid

---------------------+--------+------

2009-01-01 03:00:00 | XYZ | 10

2009-01-01 03:00:05 | XYZ | 10.5

(2 rows)

Using constant interpolation, the interpolated bid price of XYZ remains at $10.0 at 3:00:03, which falls between the two known data inputs (3:00:00 PM and 3:00:05). At 3:00:05, the value changes to $10.5. The known data points are represented by a red dot, and the interpolated value at 3:00:03 is represented by the blue star.

In order to write a query that makes the input rows more uniform, you first need to understand the TIMESERIES clause and time series aggregate functions.